Grievance Redressal

ECL Finance Limited

We at ECL Finance Limited (“ECLF/Company”) are committed to serve to make our client’s experience a rewarding one at our Company. ECLF’s Grievance Redressal Mechanism articulates our objective to minimize instances that give rise to customer complaints and create a review mechanism to ensure consistently superior service behavior.

We ensure prompt redressal of all complaints and use it for effecting necessary changes to improve the services further. In case of any complaints/grievances which customers/prospective customers (including with disabilities ) may have with respect to the lending, insurance, Recovery agents/ Agency, DSA/DMAs, IT services related vendors any outsourcing vendors may also contact through any of the following channels

|

|

a) The borrowers can directly approach the Branch Manager and enter his/her complaint/grievance in the compliant register maintained at the branch

b) The concerned Employee / Relationship Manager shall guide the borrowers who wish to lodge a complaint.

c) The borrower may also lodge complaints / grievances through any of the following channels –

Email to: assistance@eclf.com Toll free: 1-800-1026372 Monday – Friday (10 a.m. to 6 p.m.)

|

|

|

In case the customer is dissatisfied with the response received, they can also approach Grievance Redressal Officer at the following address :-

Ms. Deepika Saxena , Grievance Redressal Officer Tower 3, Wing ‘B’, Kohinoor City Mall , Kohinoor City, Kirol Road, Kurla (west), Mumbai – 400070 Tel No.+91 22-43428056 email to :- grievances@eclf.com Monday – Friday (10 a.m. to 6 p.m.)

The Grievance Redressal Officer shall endeavour to provide the borrower / applicant with the resolution / response to the queries / complaints / grievances received as earliest as possible. |

|

|

If the complaint / grievance is not redressed within a period of one month, or / and the complainant is not satisfied with the reply, the borrower / customer / complainant may appeal to the Ombudsman, Reserve Bank of India at

as per the RBI Integrated Ombudsman scheme vide Ref CEPD. PRD. No.S873/13.01.001/2021-22 dated November 12, 2021 |

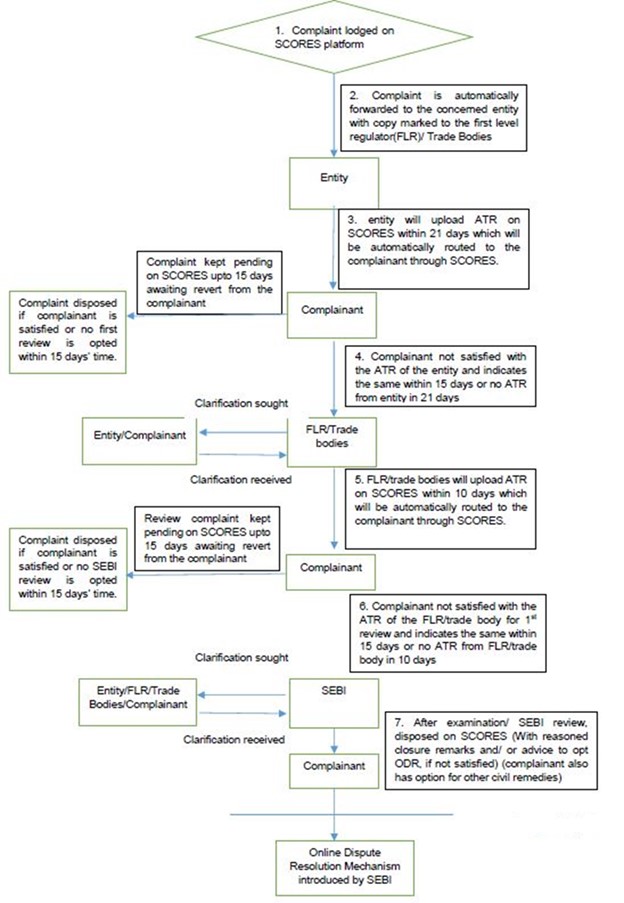

Grievance Redressal Mechanism – Investors

In case of any complaint/grievance, the investors may contact through the following channels:

|

Level 1

|

Kindly mention your PAN number in all the correspondence. A valid request only from the investor will be considered and responded by the RTA. Kindly note that the TAT of KFin RTA for response is 7 working days for emails and physical letters is 15 working days. The investors can also write letter to the RTA at the following address: KFin Technologies Limited Link Intime India Private Ltd |

|

Level 2

|

|

|

Level 3

|

|

|

Level 4

|

|