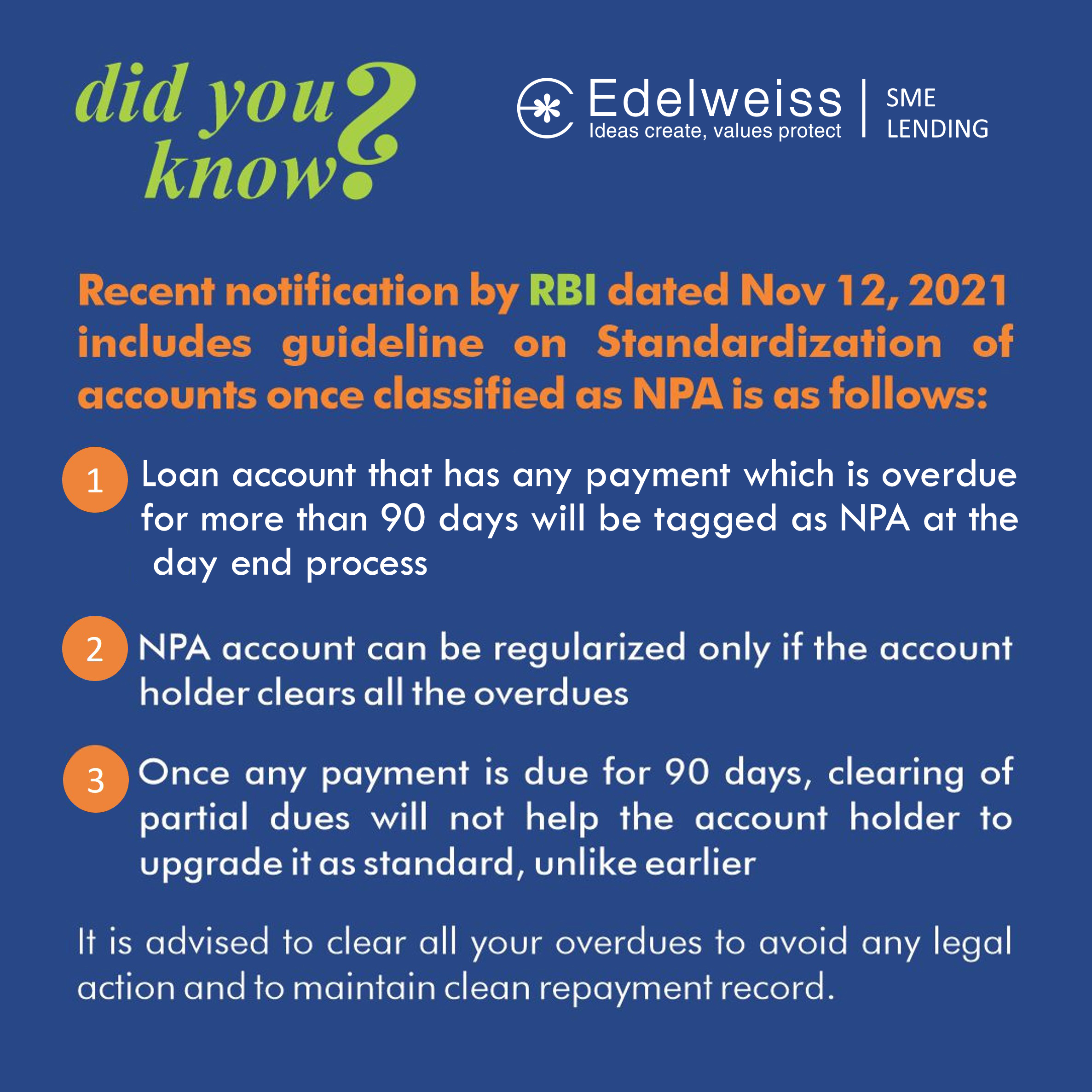

Recent notification by RBI dated November 12, 2021 includes guideline on Standardization of accounts once classified as NPA is as follows:

- Loan account that has any payment which is overdue for more than 90 days will be tagged as NPA at the day end process

- NPA account can be considered as standard only if the account holder clears all the overdues

- Once any payment is due for 90 days, clearing of partial dues will not help the account holder to upgrade it as standard, unlike earlier

Explanation:

Date of overdue: The day after the due date of EMI.

Type of Classification:

Standard Accounts

Special Mention Account (SMA):

SMA 0: 0-30 days past the due date

SMA 1: 31-60 days past the due date

SMA 2: 61-89 days past the due date

Non-Performing Asset (NPA): >=90days

Example:

If due date of a loan account is March 31, 2021, and full dues are not received before the lending institution runs the day-end process for this date, the date of overdue shall be March 31, 2021. If it continues to remain overdue, then this account shall get tagged as SMA-1 upon running day-end process on April 30, 2021 i.e. upon completion of 30 days of being continuously overdue. Accordingly, the date of SMA-1 classification for that account shall be April 30, 2021.

Similarly, if the account continues to remain overdue, it shall get tagged as SMA-2 upon running day-end process on May 30, 2021 and if continues to remain overdue further, it shall get classified as NPA upon running day-end process on June 29, 2021

It is advised to clear all your overdue to avoid any legal action and to maintain clean repayment record.

To pay your EMI now, visit our PAY EMI section on the website.